Energy plan deepens reliance on costly LNG

BY Eyamin Sajid

November 22, 2025

The recent gas price hike for industrial and captive power sectors in April left businesses in a state of shock, especially as it was announced just ten days after U.S. President Donald Trump imposed a 37% additional tariff on Bangladeshi exports.

This price hike created a ‘double whammy’ for business owners, who were already struggling to keep their businesses afloat amidst persistent gas supply shortages and unpredictable price increases for gas and electricity. The additional U.S. tariff was later reduced to 20% in August after bilateral trade issues were resolved.

The government increased the gas price by 33% to offset the deficit it has incurred from importing Liquefied Natural Gas (LNG), which costs approximately Tk55 per cubic meter.

However, the burden of such price hikes is likely to become a recurring issue as authorities increase their reliance on volatile LNG for future energy supply.

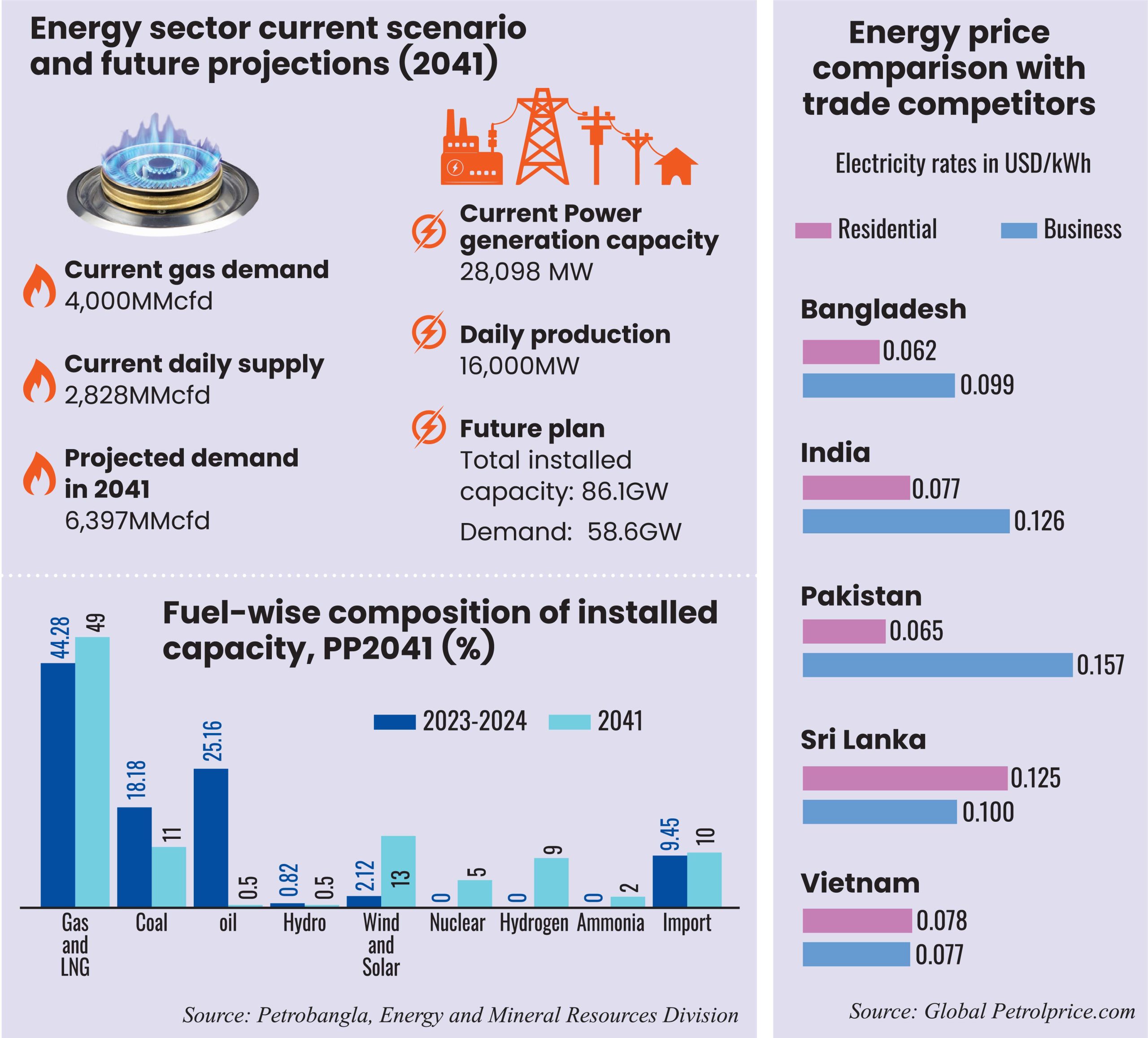

According to the Integrated Energy and Power Master Plan (IEPMP) 2023, LNG imports are projected to compensate for a natural gas supply shortfall, with demand expected to reach 6,397 mmcfd (million cubic feet per day) by 2041.

Shams Mahmud, Managing Director of Shasha Denims and a former director of the Bangladesh Garment Manufacturers and Exporters Association (BGMEA), stated that unpredictable price hikes for essential fuels like gas and electricity, coupled with the devaluation of the local currency and rising inflation, make it difficult for Bangladeshi businesses to compete globally.

“Due to the increasing cost of production, we can’t compete with our rivals and are losing clients,” said Shams Mahmud.

“If we take an order in January, for example, it may take until June or July to deliver the product. We typically estimate the product’s price based on the current cost of various components, including energy. But if the government suddenly hikes the price of energy, it impacts our production cost, which we didn’t factor in when we accepted the order.”

Data from GlobalPetrolPrices.com, a website that tracks energy costs worldwide, shows that the average business electricity rate in Bangladesh is $0.099 per kWh, compared to just $0.077 per kWh in Vietnam, a major competitor in the ready-made garment (RMG) sector.

Shams added, “Lower electricity rates mean they are a step ahead of us in competitiveness because it helps them produce goods at a lower cost.”

Dependence increases, so does uncertainty

Bangladesh’s future energy generation appears to be heavily reliant on imported fossil fuels. The new master plan designates gas and coal as the primary energy sources for electricity generation, accounting for a significant share of the total energy mix till 2041.

The previous master plan (PSMP 2016) projected that gas would account for 35% of total electricity generation by 2041. However, this seemingly ‘cheapest’ option for power generation has become more expensive as the country must now import costly LNG to fuel power plants due to declining production from local gas fields.

Despite this, the IEPMP 2023 projects that gas will account for an even larger share, estimated at 49% by 2041.

While 80% of the country’s daily gas supply currently comes from domestic fields, production is expected to decrease from the present 2,100 mmcf to 1,700 mmcf by 2041, even with efforts to improve existing wells.

To meet the projected daily demand of 6,397 mmcf in 2041, the new plan projects that LNG imports will need to increase from 5 MTPA (million tonnes per annum) to 16 MTPA, necessitating the construction of additional LNG receiving terminals. Currently, Bangladesh has two LNG terminals with a combined capacity to inject 1,100 mmcf (million cubic feet) of gas per day.

The latest plan also considers coal as the second-largest primary source of electricity generation till 2041, with the country expected to generate 11% of its total electricity from this source.

Khondaker Golam Moazzem, research director at the Center for Policy Dialogue (CPD), a local policy think tank, stated that relying on gas and coal as primary energy sources will significantly increase cost burdens.

“The targets set in the new plan are very frustrating. The policy support needed for the gradually increasing foreign investment in renewables has not been reflected in the plan,” he said.

He added that the plan appears to be influenced by countries that helped prepare the document, benefiting them more than Bangladesh.

Far from renewable goals

Bangladesh has set a target to generate 40% of its energy from clean sources by 2041, including nuclear, hydropower, ammonia, hydrogen, solar, and wind power, as well as imported hydropower.

However, the country is currently far from reaching this goal, with clean energy sources (solar, hydro, and wind) accounting for only 2.94% of the total 28,098 MW electricity generation capacity. This is a significant setback from the previous master plan (PSMP-2016), which aimed for 10% by 2030.

- Zakir Hossain Khan, chief executive at Change Initiative, a renewable energy research and advocacy organization, noted that authorities have “distorted” the renewable targets by introducing a “clean energy” term that includes unproven and expensive technologies.

“This estimate contradicts the commitments made in the NDCs to the Paris Agreement on climate change, the Mujib Climate Prosperity Plan, the Renewable Energy Policy, and, most importantly, the government’s own pledge to supply 40% of electricity from renewable sources by 2041,” said M. Zakir Hossain Khan.

He expressed concern that the new plan could discourage national and international investment in renewable energy, which had gained momentum in 2022.

Inefficiency’s impact on energy pricing

Bangladesh still experiences an average system loss of around 7% in gas distribution and 10% in electricity transmission and distribution, even in an era of advanced technology.

While there has been progress in reducing these losses over the years, the current rates are still costly for a country heavily dependent on imported primary energy sources like gas and oil.

According to Power Cell, a policy research wing of the Power Division, total distribution system loss in the power sector has decreased from approximately 17% two decades ago to 7.25% in the 2023-24 fiscal year. Similarly, system loss in power transmission has fallen from 4.05% to 3.13%.

Despite the scarcity of domestic gas reserves and the industry’s outcry, the country’s system loss of around 7% in gas transmission and distribution is fiscally irresponsible, especially given the high cost of imported LNG.

Petrobangla Chairman Md Rezanur Rahman stated that they are implementing multiple measures to reduce system loss. These include deploying four executive magistrates to disconnect illegal connections.

“We are also installing prepaid gas meters in households and EVc meters in industrial settings to prevent gas pilferage. Additionally, we are planning to replace old distribution lines to stop gas leakages,” Rezanur Rahman told journalists in late July.

He added, “To ensure energy efficiency, we are conducting energy audits in different industries and scrutinizing machine efficiency before providing new industrial gas connections.”

Eyamin Sajid is the Fact-Check editor at Agence France-Presse based in its Dhaka bureau. Eyamin has 14 years of work experience at various media outlets in Bangladesh. Prior to joining AFP, he was a senior correspondent at The Business Standard, a leading English-language business daily in Bangladesh.

Most Read

Understanding the model for success for economic zones

From deadly black smog to clear blue sky

How AI is fast-tracking biotech breakthroughs

Starlink, satellites, and the internet

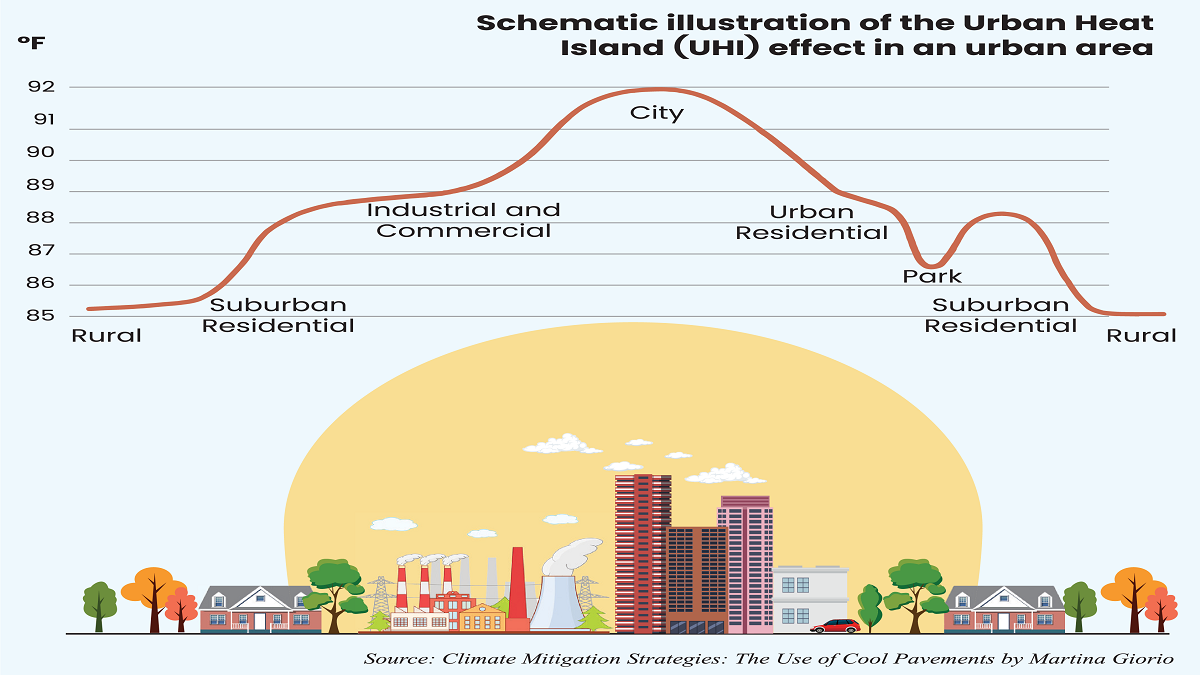

What lack of vision and sustainable planning can do to a city

A nation in decline

Does a tourism ban work?

Case study: The Canadian model of government-funded healthcare

A city of concrete, asphalt and glass

You May Also Like